How to Integrate Blockchain for Real Estate Tokenization and Fractional Ownership

When it comes to one of the oldest and most valuable asset classes in the world, real estate is the top name that comes to everyone’s mind. But, in the previous generations, it was not very accessible and also consisted of high prices, paperwork, legal restrictions, and long times for transactions, which prevented people from investing.

Thankfully, Blockchain for Real Estate Development is changing that for the good, and that too rapidly.

With the help of blockchain, real estate can be tokenized (dividing digital shares) so that anyone can buy, sell, or trade. This approach of fractional ownership makes the real estate industry thrive with more investments, flexibility, affordability, and transparency.

So, how can you integrate blockchain for real estate tokenization and take your business to the technologically advanced stage? Here is a step-by-step guide to give you a clear view of what it takes to bring property to the blockchain.

What is Real Estate Tokenization?

Before we head to the core of this article, the first thing is to understand the concept of real estate tokenization.

It is a process of turning a physical property or investment, like an apartment building or a commercial space, into a digital token that exists on a blockchain. Such tokens represent different kinds of ownership, like

- A share in a property

- A rental income stream

- A stake in future profits

Once a property is tokenized, it becomes easier to divide and sell to multiple sellers in the form of fractional ownership, just like how people buy stocks in the stock market.

Why Tokenize Real Estate? Key benefits

The process of tokenization solves a lot of traditional problems that were faced by investors and owners. Both parties have their benefits, as stated below.

Benefits for Investors

Investors can invest in properties as per their budget, as smaller amounts of investment shares are there for them.

- Easily buy and sell the tokens on the digital marketplace.

- Spreading investment across multiple properties, locations, and markets is also known as diversification.

- The transparency of blockchain is top-notch, with the best security.

Benefits to the property owners

- Access to global investors.

- Much faster fund-raising method.

- Full automation through smart contracts

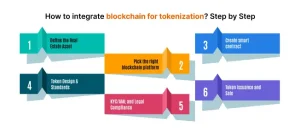

How to integrate blockchain for tokenization? Step by Step

Now, it is time that we break down the complete process of integrating blockchain for tokenization into easy steps.

#1 Define the Real Estate Asset

The foremost step is to select the asset that is to be converted into a token form. It can be a residential or commercial property, a real estate investment trust (REIT), or a future real estate development project.

Here, note that the property must be owned legally with proper documentation, and the tokenization of the same is permitted by local laws. In some of the countries, the regulatory frameworks for digital assets are evolving, so it’s good to work with a legal expert to align with the compliance.

#2 Pick the right blockchain platform

The next step is to pick the blockchain where the tokens will be issued from the common platforms available. Some of these platforms are.

- Ethereum, which is popular for smart contracts, has wide support.

- Polygon is a scalable, low-cost chain compatible with Ethereum.

- Binance Smart Chain, or BSC, is fast and affordable and provides an ideal token-trading process.

The above-mentioned blockchains, available to choose, will determine the behavior of the token and how easy it is to interact with the services like exchanges and wallets.

#3 Create Smart Contract

If you don’t know about smart contracts, they are programs that run on the blockchain. They are the ones defining how your real estate tokens will work with ownership rules, voting rights (if applicable), dividend or rent payouts, and transfer limitations. This is also where one can hire smart contract developer because writing these contracts requires deep technical expertise with legal understanding.

The contracts should be secure and transparent and must be able to handle thousands of transactions without any failure. You can also hire a smart contract developer if you want to alter your existing smart contracts.

#4 Token Design and Standards

You will need to decide how the token will be structured. That is how.

- Will it be equity-based, representing actual ownership in the property?

- Will it represent a loan or an interest-bearing token?

- Will it give users access to property-related benefits like hotel bookings and other shared space access?

Most projects use ERC 20 or ERC 1400 token standards for real estate because these standards have wide support and give features like compliance checks, identity restrictions, and so much more.

#5 KYC/AML and Legal Compliance

Now, since real estate tokens give a representation of real-world financial assets, you will need to apply KYC (Know Your Customer) to verify user identity before they invest. Also, you need anti-money laundering prevention and investor accreditations because, in some countries, only certified investors can buy a certain type of asset.

#6 Platform Development and User Dashboard

Once everything is set and clear, you can hire a blockchain app development company to build the platform where users can actually

- View real estate opportunities.

- Purchase tokens.

- Track the performance and earnings.

- Receive updates about dividends.

The process of development consists of the front end (app interface), the back end (handling core processes), and wallet integration for sending and receiving the tokens.

#7 Token Issuance and Sale

When your platform and smart contracts are ready, you can launch the sale of tokens. You may do this through:

- A private sale to accredited investors

- A public offering (but it depends on legal permission)

- Listing on a digital asset exchange

While you are in this phase, remember that transparency is the key, and you have to provide full documentation about the property, token economics, risks, and investors’ rights.

#8 Secondary Market and Liquidity Options

After the launch, tokens must be tradeable with the aim to create liquidity and let investors exit whenever they want. For this you can integrate decentralized exchanges like Uniswap or Sushiswap.

Further, you can also list on security token exchanges like tZero or INX. Or just offer peer-to-peer transfer with smart contract rules.

#9 Maintenance and Reporting

Finally, once your systems are up, live, and running, you will need to distribute the rental income or profit share. You also have to keep updating the token holders with the performance of their property and handle governance in case token holders have voting rights.

Not only this, it is also important to maintain the legal and tax records. Here, the best part is that blockchain highly simplifies all of this through automation and transparency.

Challenges to Watch Out For

Undoubtedly, the benefits of applying blockchains are huge, but some hurdles may arise while implementing them. Some of the common challenges can be:

- Legal uncertainty, as regulations may vary across countries and in some places, is still evolving.

- User education is important because many investors are new to blockchain and require proper guidance.

- A poorly written smart contract is vulnerable to exploitation, so it’s important for you to undermine the possible security risks.

Final Words- Ready to get started?

Fractional ownership using blockchain is not just a trend and is a revolution. We are happy to help you if you’re looking for a top-tier blockchain app development company that has a rich portfolio of transforming businesses with blockchain.

Whether you are a property developer, tech founder, fund manager, or a CTO planning to have a solution for a specific problem, you can explore our full suite of blockchain solutions like smart contract development services.

Let us build the future of real estate together. We are just a click away!